Mo’ Money, Mo’ Problems [Part Three]

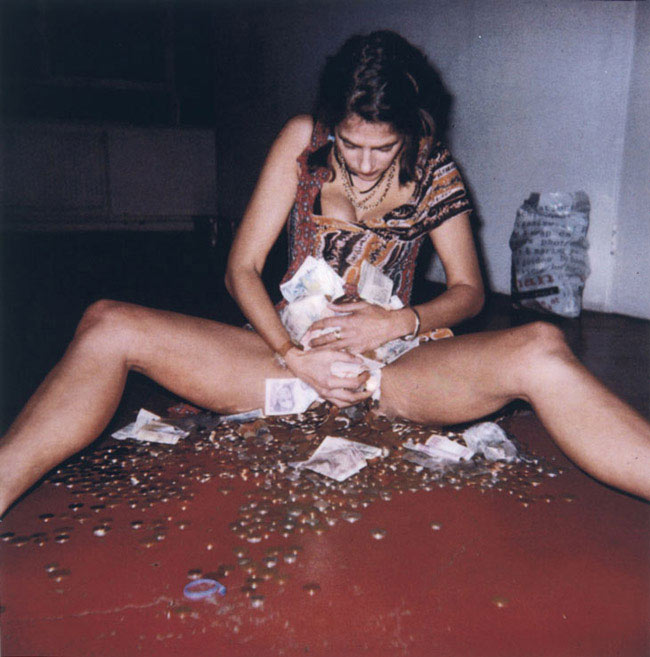

Tracey Emin’s I’ve Got It All.

I’m no Suze Orman, but I know a little bit about money. So here is a super-simplistic overview of what I’ve learned!

Gala’s Guide To Sane Spending

1. Don’t spend it before you earn it! This is SUCH a simple premise but so few people take it to heart, & end up in the poop. If you don’t have the money in the bank RIGHT NOW, you have no right to buy it. Cool your heels. Most things we “really really want” are completely forgotten about in a day anyway!

2. Never pay full retail. It’s so unnecessary! Everyone has a sale at some point, & with the advent of sites like Gilt, Ideeli & Rue La La, you’ll realise that you really don’t have to pay full whack for something. (Be careful of “rush sale” sites though, the temptation is intense!) Even doing a lot of your shopping on sites like Amazon makes a huge difference. Have you seen their prices on cosmetics, stationery, even shoes? I buy so many simple, everyday items through Amazon because their prices really are the best.

3. Use online coupons ruthlessly. I discovered a site a little while ago called Retail Me Not which is basically a huge repository of coupons for various sites. You name it, they have it. There are vouchers for everything, from Victoria’s Secret to your favourite business card printing service. I check Retail Me Not before I buy ANYTHING & often save 30% on my purchases. I will almost always get free shipping at least! Amazing!

4. Recognise that anything you “want” is just that — a want. You don’t NEED any of these things. Will it kill you to go without this or that item? Probably not.

5. Think before you hand over the money. There’s no rush (& this is true of pretty much everything!). I hardly EVER buy something the first time I’ve seen it. I go in, try it on, think about it, research the best prices & then make an INFORMED DECISION.

6. Use cash instead of plastic. When you’re actually handing over the bills one by one, & counting them with your fingers, it makes you really aware of how much money you’re spending. A lot of us just throw a card over the counter & sign it off without even glancing at the total. This is a recipe for absolute disaster!

7. Pay off your credit card & STOP USING IT. Hold onto it for emergencies but put it somewhere else. Have someone you trust look after it — preferably your most sane parent, as opposed to your I-used-to-have-a-gambling-problem-but-I-am-totally-fine-now! cousin. CLEAR YOUR CREDIT CARD INFO OUT OF YOUR BROWSER COOKIES!!! (I know.) Try to forget the number if you’ve memorised it. Or you can always take a Sharpie & write something across the front of your card. …It doesn’t really work though. I used to have DON’T DO IT scrawled across the front of my old Visa but I still used the card so much the lettering was almost entirely worn off.

8. If you have debt, sit down with all your figures & work out how much you actually owe. This can be terrifying but knowledge is power. If numbers make your head swim, enlist the help of a smart or savvy friend or family member. Write down your interest rate, your minimum monthly payments & the next due date. Then do your absolute best to make those payments. Write them on a calendar AHEAD of time — make sure you have advance notice. Fees for late payments can be insane & can be 100% avoided if you’re organised!

9. Call your bank & negotiate a lower interest rate on your credit card. Here’s how to do it.

10. If you really do need something… Buy vintage. Buy from small, independent businesses. Use Etsy & support individuals, instead of huge corporations. Buy it on sale through Gilt or Ideeli. Use Google Shopping to compare online shopping prices & get the best deals.

Extra For Experts:

Choking On Credit Card Debt from Forbes.

Choking On Credit Card Debt from Forbes.

Mint.com offers a bunch of amazing, FREE online tools to help you manage your money… & consequently, your sanity.

Mint.com offers a bunch of amazing, FREE online tools to help you manage your money… & consequently, your sanity.

Does your spending need to be examined? What steps are you going to take? Do you know anyone who has beaten massive debt? How did they do it? Has this three-part series given you pause or helped give you any ideas about the way you handle your finances?

Thanks, as always, for listening & contributing!